WISO Steuer Sparbuch Crack

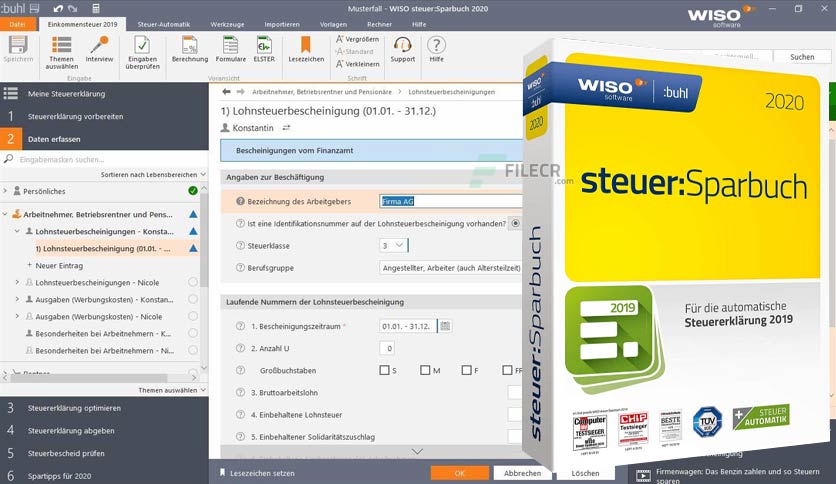

WISO Steuer Sparbuch 2021 v28.01 Build 1828 Crack is a powerful tax preparation software designed to make filing taxes a seamless and efficient process for individuals and small businesses. With its intuitive interface and extensive features, this software caters to users with varying levels of tax complexity, ensuring accuracy and compliance with the latest tax regulations. Whether you’re a freelancer, self-employed professional, or a salaried employee, WISO Steuer Sparbuch Mac Crack is your go-to solution for optimizing deductions and streamlining the tax filing experience.

Explore the rich set of features in WISO Steuer Sparbuch Full Crack, offering users a comprehensive toolkit for simplified tax management. The software supports various tax forms, including income tax, capital gains tax, business tax, and more. Automatic plausibility checks and error correction features enhance accuracy, providing users with confidence in their tax returns. WISO Steuer Sparbuch Latest Crack also includes detailed financial planning tools, allowing users to project tax implications and optimize financial decisions. With a built-in document management system, users can organize and securely store tax-related documents for easy retrieval during audits. The software’s compatibility with both Windows and macOS ensures a versatile tax preparation experience.

WISO Steuer Sparbuch Crack Features:

1. Multi-Form Support

Prepare various tax forms, including income tax, capital gains tax, business tax, and more, accommodating the diverse needs of individual taxpayers and small businesses.

2. Plausibility Checks and Error Correction

Automatic plausibility checks and error correction features enhance the accuracy of tax returns, helping users avoid common mistakes and ensuring compliance with tax regulations.

3. Financial Planning Tools

Access detailed financial planning tools to project tax implications, optimize financial decisions, and plan for future tax obligations effectively.

4. Document Management System

Utilize a built-in document management system to organize and securely store tax-related documents, providing easy access during audits and ensuring compliance with record-keeping requirements.

5. Comprehensive Reporting

Generate comprehensive reports on income, deductions, and tax liabilities, providing users with a clear overview of their financial situation and facilitating strategic financial planning.

6. Real-Time Updates

Stay informed with real-time updates on tax regulations, ensuring that users are aware of any changes and can adjust their tax strategies accordingly.

System Requirements

Operating System: Compatible with Windows 10, 8.1, 8, and 7.

Processor: 1 GHz or faster processor.

RAM: 2 GB RAM or more for optimal performance.

Hard Disk Space: 1 GB of free disk space for installation.

WISO Steuer Sparbuch 2021 v28.01 Build 1828 100% Working Keys 2024

WISO Steuer Sparbuch Product Key

J3994-54V6F-TYC5X-GOM0R-101PG

FNSSF-M8GTK-B8829-2DKPP-RM38S

WISO Steuer Sparbuch Serial Key

VFG4U-LLVYO-85E1Q-BI3KB-A6460

0STDM-HI3H6-3I110-S4549-9P86K

WISO Steuer Sparbuch License Key

DTN5E-PK2QG-8Y7E6-03WDS-96MZR

5H6KU-ZO81L-N4A58-QOXV6-5FQTK

WISO Steuer Sparbuch Activation Code

UAV08-E9UC6-G0H73-C2XA9-3A4A3

YI7GM-930L0-5QPK9-4EXCH-2WRA7

How To Crack & Install WISO Steuer Sparbuch 2021 v28.01 Build 1828

- First download the latest version.

- Uninstall the previous version with Smarty Uninstaller Crack, If Installed.

- Note Turn off the Virus Guard.

- After downloading Unpack or extract the rar file and open setup (use Winrar to extract).

- Install the setup after installation close it from everywhere.

- Please use Keygen to activate the program.

- After all of these enjoy the WISO Steuer Sparbuch 2021 v28.01 Build 1828 Crack Latest Version 2024.